Tax season is here again, and we know how eager you are to receive your refund as quickly as possible. To help keep things on track, make sure to follow a few key steps as you file:

1. Use your full direct deposit number when filing your tax return — not your base account number.

Using the wrong number can cause your refund to be returned, which leads to delays and slows down access to your funds.

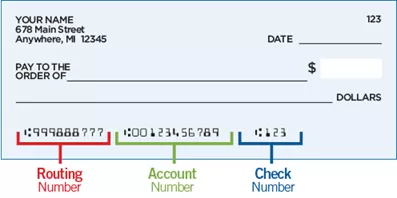

2. Know where to find your full direct deposit number.

You can locate it:

3. Access your tax forms easily in Online Banking.

Just head to the Documents and Statements section to view or download what you need.

Tax season doesn’t have to be stressful. Double-check your account number, file confidently, and avoid refund delays. If you have any questions or need help at any point, we’re here for you — on our website, in branch, or by phone at (888) 213-2848.